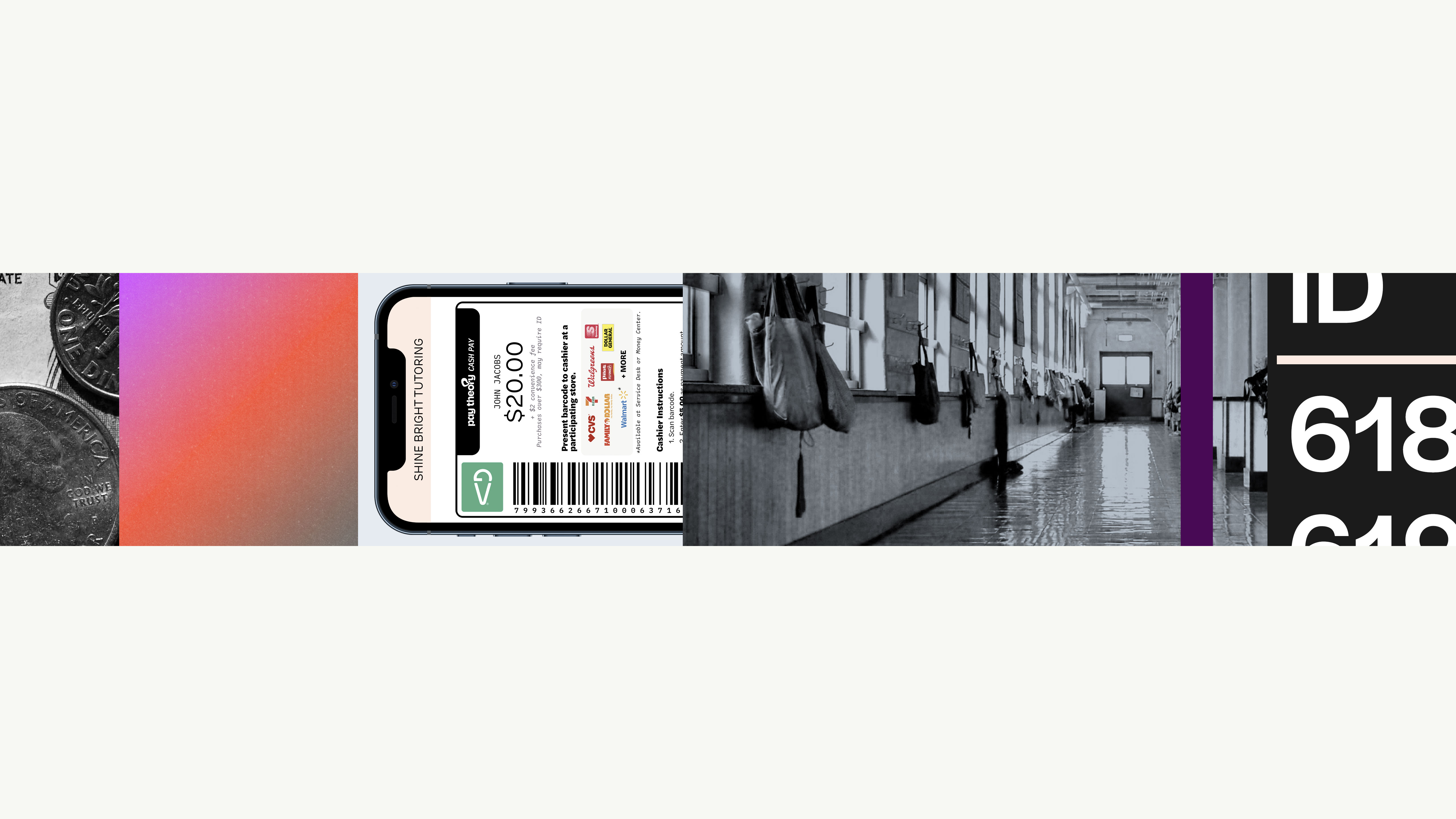

3 Reasons Going Cashless Is Destructive

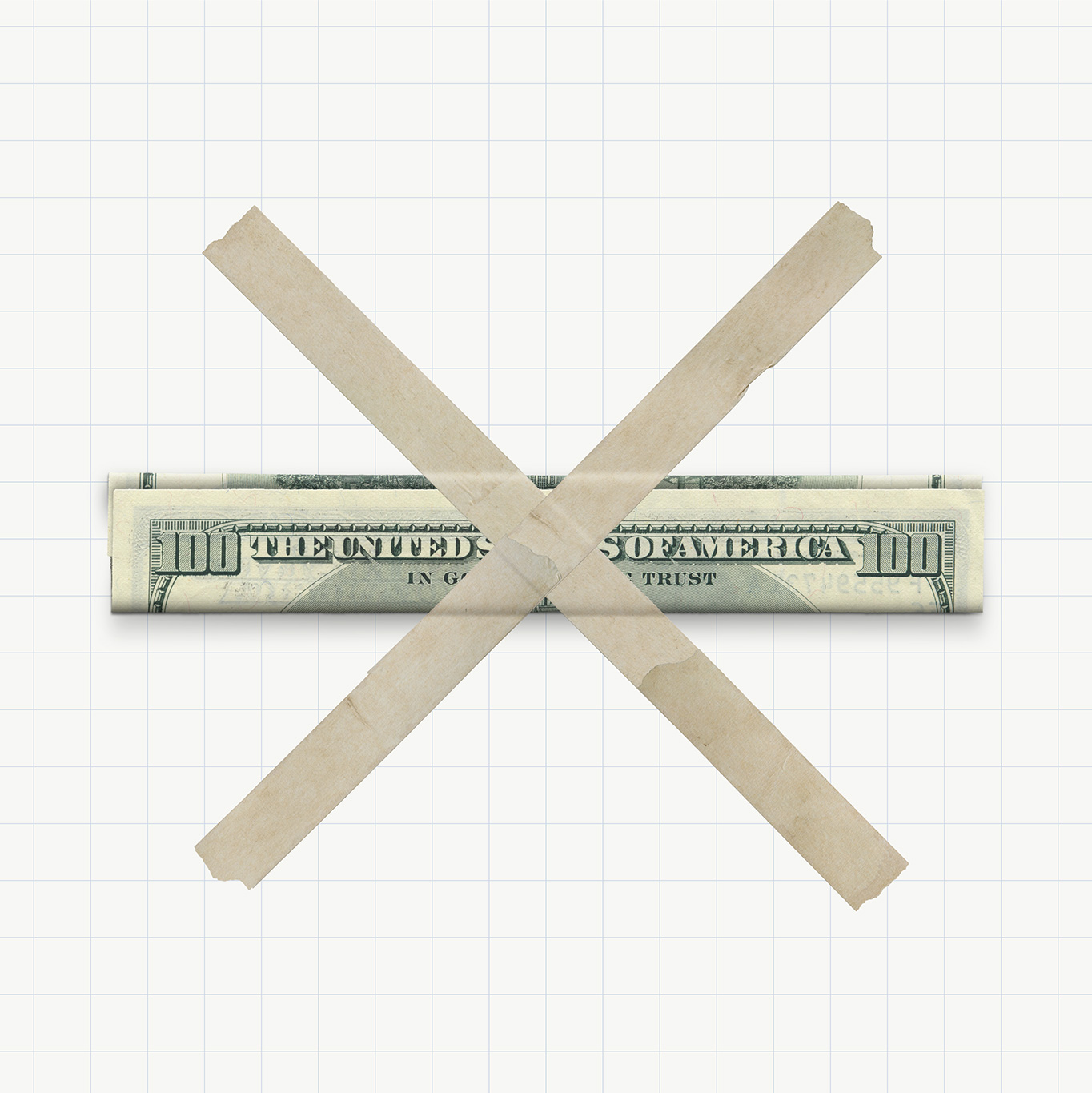

In 2019, San Francisco issued a “cashless” ban that required small businesses to accept cash payments. Despite the growing popularity of online shopping and contactless payments, other cities have followed suit.

Why? Not all residents have access to a bank account or credit card. Going “cashless” is disproportionately harmful to underbanked communities, leaving basic goods and services unattainable to millions of people.

In this article, we give three reasons why:

It creates barriers for the roughly 30% of U.S. Family households who are un/underbanked.

It limits payment resilience

Disproportionality impacts people of color

Must-Pay Services

Handle Payments